Catalog Advanced Search

-

Includes Credits Includes a Live Web Event on 09/10/2025 at 1:00 PM (EDT)

Join us for an engaging webinar to explore the rapidly evolving landscape of financial reconciliation in the face of an explosion in data volume and fragmentation, shifting regulatory expectations and new AI technology.

This webinar explores the rapidly evolving landscape of financial reconciliation in the face of an explosion in data volume and fragmentation, shifting regulatory expectations and new AI technology. As operational efficiency becomes a competitive advantage, firms are confronting challenges around data integration, automation governance, and organizational transformation. We will discuss the current capabilities and limitations of AI in reconciliation processes, separating hype from reality, and highlight strategic approaches for modernization including legacy integration, workforce reskilling, and internal advocacy. Participants will leave with practical insights and a roadmap to build resilient, future-ready operations in an era of speed, complexity, and accountability.

Learning Outcomes

• Analyze the impact of growing data volumes and fragmentation on reconciliation processes and risk controls.

• Assess how AI and automation can be leveraged to manage exceptions, detect anomalies, and support scalable operations.

• Distinguish between AI hype and practical, deployable solutions in reconciliation, including the importance of human oversight.

Develop strategies to drive operational excellence as a competitive advantage, not just a compliance measure.Target Audience:

Financial Operations Professionals

Technology and Innovation Leaders

Compliance, Audit, and Risk Officers

Data and Analytics Experts

Change Management and Strategy ExecutivesThis program is sponsored by:

CPE Credits Redeemable with NASBA

Nicsa is pleased to offer this webinar learning activity to attendees who are seeking CPE credits. 1 CPE unit may be available for attendees of this webinar. The webinar requires no advanced preparation, no pre-requisite study and is appropriate for all who have a basic understanding of the investment management industry.

Nicsa is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org.

CPEs Earned: 1

CPE Field of Study: Information Technology

Program Level: Basic

Delivery Method: Group-Internet Based

Advanced Preparation: None

CE Credits Redeemable with Investments & Wealth Institute™ (IWI)

Nicsa is a registered sponsor with the Investments & Wealth Institute™ (IWI) for continuing education credits applicable to CIMA®, CPWA®, RMA®, and CIMC® certifications. This 60-minute webinar has been pre-approved by IWI for 1 CE credit.

To redeem your CE credit, you must self-report your participation by visiting the Investments & Wealth Institute™ website: https://investmentsandwealth.org. Following the conclusion of the webinar, please enter the program date, program ID, program title, and Nicsa as the sponsoring organization. Nicsa will not report your participation on your behalf.

The Investments & Wealth Institute™ has final authority on the acceptance of individual courses for CE credit. If you have any concerns or complaints regarding registered sponsors, you may submit them via the IWI website: https://investmentsandwealth.org/contact-us.

CPEs Earned: 1

Continuing Education Topic: Risk Management and Asset Protection

Program Format: Live Webinar

CANCELLATIONS AND REFUNDS: Due to this program being offered free of charge, there will be no refunds issued. Questions or Cancellations: Please contact Lilly Bahmani at info@nicsa.org

Please note by registering for this webinar, you are consenting to Nicsa sharing your information with the sponsor of this webinar, who may subsequently contact you. You may unsubscribe from these communications at any time. For more information, check out our Privacy Policy

Murray Campbell

Principal Product Manager

AutoRek

Murray has over 10 years of experience working in investment businesses across regulatory compliance and operational resilience. At AutoRek, Murray is a Principal Product Manager with a remit covering Sales and Marketing, Client Implementation and Regulatory Product Development. Murray has also regularly contributed across a number of industry events, including Goodacre, TISA and TSAM events in addition to AutoRek webinars and breakfast briefings.

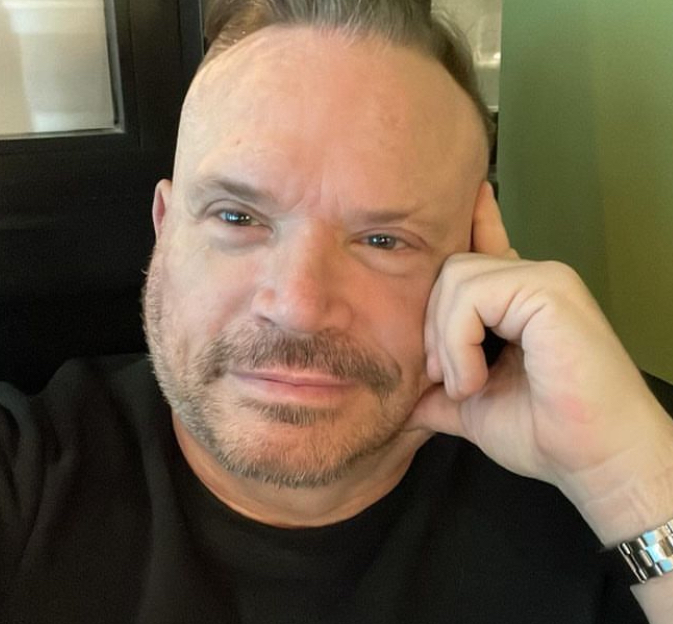

Dan Houlihan

Chief Executive Officer, STP Investment Services

Dan Houlihan is Chief Executive Officer of STP Investment Services. Prior to joining STP Investment Services, Dan spent over fifteen years serving in executive leadership positions at Northern Trust. Most recently he was Executive Vice President and Head of Asset Servicing for the Americas. Prior to Northern Trust, Dan was a founding partner of Citisoft, a leading advisory consulting firm to global financial services and technology firms. Dan served as President of Citisoft where he was responsible for their North American business.

In addition to his direct work and leadership experience, Dan served as Chairman of the Board of NICSA, sits on multiple non-profit Boards (including NICSA) and is a frequent speaker and author on complex industry topics across operations and technology.

Philip Kolb

Head of Operations, Rockefeller Capital Management

Philip Kolb is Head of Operations at Rockefeller Capital Management.

Prior to Rockefeller, Phil was Managing Director and Head of Product Operations and Account Services at Morgan Stanley. In this capacity he was responsible for the full end to end service delivery of many of the Wealth Management Investment products offered through the firm’s financial advisor network.

Over the years, Phil has built an extensive network and has been a member of multiple Financial Services industry groups. Most recently he sat on the Executive Board at NICSA and served as Chairman of the Membership Committee from 2016 to 2019. He has been a member of DTCC’s Senior Advisory Board for Wealth Management. He has been a frequent contributor and speaker at industry conferences on topics including, the impacts of DOL Fiduciary Rule, the role of Artificial Intelligence in Operations and Alternative Investment operating standards.

Phil is an experienced leader who has held multiple management positions over his 41+year career in Financial Services. Phil held multiple management positions at Merrill Lynch and has significant global experiences and influence and has resided in New York, New Jersey, Singapore and Zurich, Switzerland.

Phil has been active in various philanthropic and socially conscious endeavors. He currently is on the global Board of Directors of Kick4Life, a unique sports and education organization focused on transforming the lives of young men and women. Over the years he has been active with The United Way, The Xavier High School Alumni Giving Campaign, and various local New York/New Jersey charities and The Mary Millus Foundation, where Phil also serves on the Board.

Frank Farnesi

Head of Global Operations, STP Investment Services

Frank Farnesi is a seasoned executive with over 20 years of experience driving operational excellence and innovation across leading financial institutions, including State Street Corporation, Morgan Stanley, and SEI Investments. Since 2019, Frank has served as Senior Vice President of Operations at STP Investments, where he oversees key initiatives to enhance operational efficiency and align data and technology strategies with client goals.

Prior to STP, Frank led the Global Enterprise Business Solutions team at State Street, where he was responsible for data delivery and management, operational controls, and control product management. His leadership in integrating business knowledge with advanced technology solutions consistently delivered measurable results and positioned his teams to meet both current and future client needs effectively.

Frank’s strong educational foundation complements his professional expertise. He holds a Master’s degree in Organizational Leadership from Cabrini College, a BSED from West Chester University, and a Project Management certification from Pennsylvania State University.

With a proven track record of transforming operations and delivering client-focused solutions, Frank is committed to driving sustainable growth and innovation in the investment operations landscape.

-

Register

- Prices available after logging in

- More Information

-

Register

-

Includes Credits Includes a Live Web Event on 07/16/2025 at 1:00 PM (EDT)

Join us to discover how GenAI is empowering firms to move beyond data overload and achieve a new level of investment intelligence.

The asset management industry is awash in data, yet extracting timely and actionable insights remains a significant challenge. Traditional data access methods often struggle with the sheer volume, velocity, and variety of information, leading to missed opportunities and inefficiencies.

This webinar, hosted by Vectara and NICSA, will explore how Generative AI (GenAI) is revolutionizing data access and fundamentally transforming the way investment professionals unlock critical insights. Attendees will learn how GenAI-powered solutions can dramatically improve the ability to query complex datasets using natural language, synthesize disparate information from both structured and unstructured sources, and generate concise, relevant summaries.

We will dive into practical applications, discuss the benefits of enhanced data accessibility for decision-making, and address key considerations for successful GenAI implementation in the asset management landscape.

Join us to discover how GenAI is empowering firms to move beyond data overload and achieve a new level of investment intelligence.

Learning Outcomes

- Enable natural language querying.

- Synthesize disparate information.

- Generate concise and trusted summaries.This program is sponsored by:

CPE Credits Redeemable with NASBA

Nicsa is pleased to offer this webinar learning activity to attendees who are seeking CPE credits. 1 CPE unit may be available for attendees of this webinar. The webinar requires no advanced preparation, no pre-requisite study and is appropriate for all who have a basic understanding of the investment management industry.

Nicsa is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org.

CPEs Earned: 1

CPE Field of Study: Information Technology

Program Level: Basic

Delivery Method: Group-Internet Based

Advanced Preparation: None

CE Credits Redeemable with Investments & Wealth Institute™ (IWI)

Nicsa is a registered sponsor with the Investments & Wealth Institute™ (IWI) for continuing education credits applicable to CIMA®, CPWA®, RMA®, and CIMC® certifications. This 60-minute webinar has been pre-approved by IWI for 1 CE credit.

To redeem your CE credit, you must self-report your participation by visiting the Investments & Wealth Institute™ website: https://investmentsandwealth.org. Following the conclusion of the webinar, please enter the program date, program ID, program title, and Nicsa as the sponsoring organization. Nicsa will not report your participation on your behalf.

The Investments & Wealth Institute™ has final authority on the acceptance of individual courses for CE credit. If you have any concerns or complaints regarding registered sponsors, you may submit them via the IWI website: https://investmentsandwealth.org/contact-us.

CPEs Earned: 1

Continuing Education Topic: Applied Statistics and Data Interpretation

Program Format: Live Webinar

CANCELLATIONS AND REFUNDS: Due to this program being offered free of charge, there will be no refunds issued. Questions or Cancellations: Please contact Lilly Bahmani at info@nicsa.org

Please note by registering for this webinar, you are consenting to Nicsa sharing your information with the sponsor of this webinar, who may subsequently contact you. You may unsubscribe from these communications at any time. For more information, check out our Privacy Policy

Sean Anderson (Moderator)

Head of Marketing

Vectara

Sean is a data, machine learning, and analytics marketer/practitioner/lover with a strong focus on innovative open-source ecosystems. He has been a key player in integral technological shifts, including the rise of cloud computing, open-source standardization, big data, and machine learning. Sean quickly became a go-to resource and speaker for data and analytics workloads focusing on technologies like machine learning, data science, data engineering, Apache Spark, Apache Hadoop, MongoDB, Redis, ElasticSearch, SQL and data warehousing. Recently, Sean has been immersed in the world of generative AI, tackling practical applications and on a mission to eliminate LLM hallucinations.

At Rackspace Hosting, Sean helped define the company brand around delivering cloud-based database services, including the launch of cloud data products for Hadoop, MongoDB, Elastic Search and Redis. At Cloudera, Sean was responsible for Apache Spark and data science marketing. He launched a new capability to bring common, open-source data science practices to distributed data with the introduction of The Cloudera Data Science Workbench. At StreamSets, Sean led programs and research around data engineering and data pipelines. This included authoring several definitive research products on the emerging discipline of DataOps. Sean managed a cross-functional team of product marketers, product-led growth marketers, and developer advocates. At Select Star, Sean was the foundational marketing hire and managed the company's content, analyst, and events strategies.

Sean is currently Head of Product Marketing at Vectara, managing the company's strategy for content, analyst relations, and community. Vectara is entering the market with one of the world's best retrieval and hallucination evaluation models.

Jeff Chapman

Field CTO

Vectara

Jeff Chapman is an experienced technology leader and AI expert, currently the Field CTO at Vectara, where he helps enterprises deploy Generative AI solutions. With Vectara’s serverless Retrieval-Augmented Generation (RAG)-as-a-Service, Jeff focuses on enabling organizations to build secure, scalable AI-powered assistants that leverage their data for accurate and explainable insights.

Before Vectara, Jeff held technology leadership roles at UBS, ING, and Capital One, where he led AI and technology innovations across global banking operations. A UCLA graduate in Computer Science, he has a strong background in AI, data architecture, and enterprise solutions.

Mike Booth

Eastern Region Sales Leader

Vectara

Michael Booth leads Northeast Sales at Vectara, where he is dedicated to helping organizations in the region leverage the power of Retrieval-Augmented Generation (RAG) to build accurate, grounded, and secure generative AI applications. His role involves understanding client needs, demonstrating Vectara's value proposition, and driving successful adoption of RAG technologies. Beyond his contributions at Vectara, Michael is an active participant in the NICSA Innovation and Technology Strategy Committee. In this capacity, he contributes his deep expertise in AI and emerging technologies to help shape strategic discussions and initiatives within the financial services industry, focusing on how innovation can drive efficiency and address key challenges.

-

Register

- Prices available after logging in

- More Information

-

Register

-

Join Nicsa for a comprehensive webinar series that explores how AI is revolutionizing the financial services industry, from foundational concepts like AI and generative AI to practical applications in product distribution, investment strategies, portfolio management, and legal considerations. Gain valuable insights into the latest AI trends, real-world applications, and strategic approaches essential for success in an evolving financial landscape.

This webinar series is designed to provide our community with a comprehensive understanding of how AI is transforming the financial services industry. It will cover a range of topics, starting with an introduction to AI and generative AI, followed by sessions on practical applications in product and distribution, AI in investment strategies and portfolio management, legal and regulatory considerations, and more. Attendees will gain insights into the latest AI trends, practical applications, and strategic considerations necessary to thrive in a rapidly evolving financial landscape.

-

Register

- Prices available after logging in

- More Information

-

Register

-

Join us to discuss the results of the research to explore any linkage between cognitive diversity and the performance of investment teams

In 2024, the Diversity Project invited academics from around the world to submit research proposals to explore any linkage between cognitive diversity and the performance of investment teams. We stressed that we wanted to know what the evidence showed, not work backwards from any conclusion we might hope to see.

We defined cognitive diversity as the range of expertise, experience, perspectives, preferences, traits and ways of thinking within a team.

Join Stephanie Niven, Portfolio Manager at Ninety One and Alex Edmans, Professor of Finance at London Business School and the author of books such as "Grow the Pie" and "May Contain Lies" for this exciting global webinar where we discuss the results of the research.

CANCELLATIONS AND REFUNDS: Due to this program being offered free of charge, there will be no refunds issued. Questions or Cancellations: Please contact Lilly Bahmani at info@nicsa.org

Please note by registering for this webinar, you are consenting to Nicsa sharing your information with the sponsor of this webinar, who may subsequently contact you. You may unsubscribe from these communications at any time. For more information, check out our Privacy Policy

Stephanie Niven

Portfolio Manager

Ninety One

Alex Edmans

Professor of Finance

London Business School

-

Register

- Prices available after logging in

- More Information

-

Register

-

Includes Credits

Join us for an engaging webinar to explore the challenges and opportunities of navigating rapid growth of Alternatives in an increasingly complex market – across pre-trade, trade, and post-trade environments.

In this session, we’ll explore the challenges and opportunities of navigating rapid growth of Alternatives in an increasingly complex market – across pre-trade, trade, and post-trade environments. As client demand and advisor interest soar, the introduction of new entrants and evolving products has led to a fragmented and operationally fragile environment. Join us as we unpack the core operational and technological hurdles facing the industry today.

Learning Outcomes

• Identify key client/advisor onboarding, operational, and scalability challenges.

• Understand the risks posed by insufficient: onboarding experience, compliance controls, automation, and expertise.

• Explore how an integrated operational and technology solution can support growth while maintaining consistency and control.

• Evaluate when to outsource vs. building capabilities based on business needs.

• Learn how SS&C ALTSERVE BPO and ALTSERVE Connect can provide flexibility and stability during high-growth phases.Target Audience:

Asset and Wealth Management Professionals Focused on Alternatives

Financial Advisors and Client Relationship Professionals

Risk and Compliance Officers

Technology and Automation StrategistsThis program is in partnership with:

CPE Credits Redeemable with NASBA

Nicsa is pleased to offer this webinar learning activity to attendees who are seeking CPE credits. 1 CPE unit may be available for attendees of this webinar. The webinar requires no advanced preparation, no pre-requisite study and is appropriate for all who have a basic understanding of the investment management industry.

Nicsa is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org.

CPEs Earned: 1

CPE Field of Study: Specialized Knowledge (Technical)

Program Level: Basic

Delivery Method: Group-Internet Based

Advanced Preparation: None

CE Credits Redeemable with Investments & Wealth Institute™ (IWI)

Nicsa is a registered sponsor with the Investments & Wealth Institute™ (IWI) for continuing education credits applicable to CIMA®, CPWA®, RMA®, and CIMC® certifications. This 60-minute webinar has been pre-approved by IWI for 1 CE credit.

To redeem your CE credit, you must self-report your participation by visiting the Investments & Wealth Institute™ website: https://investmentsandwealth.org. Following the conclusion of the webinar, please enter the program date, program ID, program title, and Nicsa as the sponsoring organization. Nicsa will not report your participation on your behalf.

The Investments & Wealth Institute™ has final authority on the acceptance of individual courses for CE credit. If you have any concerns or complaints regarding registered sponsors, you may submit them via the IWI website: https://investmentsandwealth.org/contact-us.

CPEs Earned: 1

Continuing Education Topic: Traditional and Alternative Investments

Program Format: Live Webinar

CANCELLATIONS AND REFUNDS: Due to this program being offered free of charge, there will be no refunds issued. Questions or Cancellations: Please contact Lilly Bahmani at info@nicsa.org

Please note by registering for this webinar, you are consenting to Nicsa sharing your information with the sponsor of this webinar, who may subsequently contact you. You may unsubscribe from these communications at any time. For more information, check out our Privacy Policy

Jennifer Cho (Moderator)

Strategic Relationship Executive, SS&C Brokerage Solutions

Jennifer Cho is a seasoned financial services professional with over 20 years of industry experience. She joined SS&C as the Strategic Relationship Executive for Brokerage Solutions in February 2023, driving strategic growth and client success through delivering solutions aligned with client business strategies. Prior to joining SS&C, Jennifer held various roles at PIMCO, where she launched new products and services, led teams, and served on industry committees. Jennifer holds an undergraduate degree in economics and management from the University of California, Irvine. While she enjoys cultivating relationships and engaging in industry forums, her favorite pastime is spending time with her husband of 16 years, Charlie, and exploring the world through the eyes of their toddler, Celine.

Dan Beck

Vice President of Brokerage Solutions

SS&C

Dan Beck is Vice President of Brokerage Solutions. Within this role, he is responsible for leading the day-to-day alternative investment and sub-accounting operations teams.

Dan has been in the securities industry for over 25+ years. During this time, he has had multiple roles and leadership positions across Operations. Prior to joining SS&C, Dan had worked at Ameriprise Financial Inc., Miller Johnson and Kuehn, and Piper Jaffrey.

Dan has his B.A. in Business Administration from the University of St. Thomas, St. Paul, MN. He has been a member of BDAC – Broker Dealer Advisor Committee for over 15 years and he holds FINRA Series 7 – General Securities Representative and FINRA Series 24 – General Securities Principal designations.

- 25+ years in the financial industry

- 21+ years at Ameriprise

- Married for 20 years (Kristi)

- Two Children: Kellen (17) & Lyla (14)

- Enjoy playing hockey, golfing and coaching my kids

Charles Upchurch

Sr. VP of Clearing Operations

LPL Financial

Charles Upchurch is a Sr. VP of Clearing Operations at LPL Financial. He has worked in the industry for the past 29 years. The majority of that time has been focused on running back-office operations and leading strategic corporate initiatives. During his tenure in the industry, Charles has had the opportunity to engage all core clearing functions and the privilege to lead Wealth Management, Trading, Margins, Options, Corporate Actions, Settlements/Custody/P&S, Transfers, Sweeps and Security Master teams.

He has also been involved in the industry representing the intermediary community on the ICI’s Broker Dealer Advisory Committee, the DTCC’s AIP Round Table, the DTCC’s Mutual Fund Advisory Council and on various forums and panels.

Rafay H. Farooqui

Founder, Chairman, & Chief Executive Officer

SUBSCRIBE

Rafay H. Farooqui is the Chairman, Founder and Chief Executive Officer of SUBSCRIBE, a global fintech company digitally transforming the landscape of alternative investments for fund managers, institutional investors, wealth managers, law firms, and fund administrators. Prior to SUBSCRIBE, Rafay also founded CAIS, an alternative investment platform for wealth management firms.

Mr. Farooqui started his career at Goldman Sachs in 1998 in New York and served at UBS AG from 2003 to 2008 in both New York and Dubai.

Rafay served as an Independent Director of M.D.C. Holdings Inc. (NYSE: MDC), has served on the Boards of the UN International School and Queens Museum of Art, is a Member of the Council on Foreign Relations and YPO. He has an MBA and BA from Columbia University.

-

Register

- Prices available after logging in

- More Information

-

Register

-

Includes Credits

Join us for an in-depth session exploring the evolving legal and regulatory frameworks shaping the adoption of Artificial Intelligence in asset and wealth management. This webinar will deliver a comprehensive overview of key compliance issues, data privacy concerns, and the regulatory landscape influencing AI integration. Gain actionable insights to help your organization navigate these challenges effectively, mitigate risks, and ensure alignment with evolving industry standards.

Join us for an in-depth session exploring the evolving legal and regulatory frameworks shaping the adoption of Artificial Intelligence in asset and wealth management. This webinar will deliver a comprehensive overview of key compliance issues, data privacy concerns, and the regulatory landscape influencing AI integration. Gain actionable insights to help your organization navigate these challenges effectively, mitigate risks, and ensure alignment with evolving industry standards.

Learning Outcomes:

- Understand the current regulatory landscape for AI in finance and its implications for asset and wealth management.

- Identify key data privacy and security considerations related to AI adoption.

- Learn practical strategies to address compliance challenges and manage risks in an AI-driven environment.

- Explore best practices for integrating AI while ensuring alignment with legal and regulatory requirements.Target Audience:

• Asset and Wealth Management Professionals

• Investment Managers and Analysts

• Compliance and Risk Management Professionals

• IT and Technology Leaders in Financial Services

• Business Strategists and Decision Makers

• Anyone interested in leveraging AI for business growth and efficiencyThis program is co-hosted by the Nicsa Webinar Working Group.

CPE Credits Redeemable with NASBA

Nicsa is pleased to offer this webinar learning activity to attendees who are seeking CPE credits. 1 CPE unit may be available for attendees of this webinar. The webinar requires no advanced preparation, no pre-requisite study and is appropriate for all who have a basic understanding of the investment management industry.

Nicsa is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org.

CPEs Earned: 1

CPE Field of Study: Regulatory Ethics

Program Level: Basic

Delivery Method: Group-Internet Based

Advanced Preparation: None

CE Credits Redeemable with Investments & Wealth Institute™ (IWI)

Nicsa is a registered sponsor with the Investments & Wealth Institute™ (IWI) for continuing education credits applicable to CIMA®, CPWA®, RMA®, and CIMC® certifications. This 60-minute webinar has been pre-approved by IWI for 1 CE credit.

To redeem your CE credit, you must self-report your participation by visiting the Investments & Wealth Institute™ website: https://investmentsandwealth.org. Following the conclusion of the webinar, please enter the program date, program ID, program title, and Nicsa as the sponsoring organization. Nicsa will not report your participation on your behalf.

The Investments & Wealth Institute™ has final authority on the acceptance of individual courses for CE credit. If you have any concerns or complaints regarding registered sponsors, you may submit them via the IWI website: https://investmentsandwealth.org/contact-us.

CPEs Earned: 1

Continuing Education Topic: Governance and Regulations

Program Format: Live Webinar

CANCELLATIONS AND REFUNDS: Due to this program being offered free of charge, there will be no refunds issued. Questions or Cancellations: Please contact Lilly Bahmani at info@nicsa.org

Please note by registering for this webinar, you are consenting to Nicsa sharing your information with the sponsor of this webinar, who may subsequently contact you. You may unsubscribe from these communications at any time. For more information, check out our Privacy Policy

Pam Gelormini

Occupation Director of Compliance

MFS Investment Management

Pam Gelormini is a Vice President, Director of Compliance and Privacy Officer of MFS Investment Management® (MFS®). She is responsible for MFS' employee conduct, US Funds and Advisor compliance programs, privacy and records management programs, compliance education, regulatory exam oversight and the development of compliance monitoring and testing plans. Pam has over twenty-six years professional experience at MFS working in roles within corporate insurance, risk management and compliance, assisting with the design and implementation of various compliance and risk management programs. Pam received a Bachelor of Science degree in Business Administration with a concentration in Finance from Sacred Heart University. She is also a Certified Information Privacy Professional in the US (CIPP/US) with the International Association of Privacy Professionals.

Rosa Licea-Mailloux (Moderator)

Head of Compliance Americas; Chief Compliance Officer - MFS Funds

MFS Investment Management

Rosa Licea‐Mailloux is a vice president and head of compliance, Americas, at MFS Investment Management® (MFS®). She is also the chief compliance officer of the MFS Funds. In this role, she oversees all aspects of compliance for MFS investment products distributed throughout the Americas, collaborating with various groups across MFS to ensure all regulatory requirements are met and adhered to across the firm's various distribution channels.

Rosa joined MFS in 2018 as a director of corporate compliance and was named to her current role in 2022. Previously, she worked at Natixis Investment Managers for over 14 years, holding several roles in the firm’s legal and compliance groups, including chief compliance officer for the Loomis

Sayles Funds, Natixis Funds and Natixis ETFs and senior vice president and deputy general counsel for Natixis Investment Managers – US Distribution. She began her career in financial services in 2001 as a compliance specialist with Putnam Investments.

Rosa earned Bachelor of Arts degrees in biology and economics from Boston University, a Juris Doctor degree from the Northeastern University School of Law, and an MBA from UNC Kenan-Flagler Business School. She is an adjunct professor of financial sector compliance at New England Law | Boston.

Joanne Kane

Chief Compliance Officer, SS&C, GIDS, US

Joanne Kane is the Chief Compliance Officer for SS&C’s Global Investor and Distribution Solutions Division (GIDS), US. Ms. Kane joined SS&C in May of 2023 and is responsible for the full range of compliance initiatives and issues related to 40’ Act mutual funds, alternative investments, retirement plans, and SS&C’s asset management clients.

Ms. Kane has over 35 years of experience in the financial services industry, including extensive knowledge of transfer agency and compliance as well as various Securities and Exchange Commission regulations pertaining to asset managers. Prior to joining SS&C, Ms. Kane served as Chief Industry Operations Officer for the Investment Company Institute where she spent almost 10 years. Earlier in her career, she held various senior positions including as Vice President of Transfer Agent Governance and Administration for Columbia Management Investors Services, Corp. and as Assistant Vice President of Transfer Agent Compliance with IXIS Asset Management Services. Ms. Kane graduated Magna Cum Laude from Providence College with a BS degree in finance.

-

Register

- Prices available after logging in

- More Information

-

Register

-

Includes Credits

Employee Resource Groups (ERGs) play a pivotal role in shaping corporate culture by fostering a sense of belonging, driving employee engagement, and supporting diversity, equity, and inclusion (DEI) initiatives. In this insightful panel discussion, Industry Leaders will share firsthand experiences and best practices for leveraging ERGs to create a more inclusive and dynamic workplace. Attendees will gain practical strategies to enhance employee retention, leadership development, and organizational cohesion through ERG initiatives.

Employee Resource Groups (ERGs) play a pivotal role in shaping corporate culture by fostering a sense of belonging, driving employee engagement, and supporting diversity, equity, and inclusion (DEI) initiatives. In this insightful panel discussion, Industry Leaders will share firsthand experiences and best practices for leveraging ERGs to create a more inclusive and dynamic workplace. Attendees will gain practical strategies to enhance employee retention, leadership development, and organizational cohesion through ERG initiatives.

Learning Outcomes:

By attending this webinar, participants will be able to:

• Understand the strategic role of ERGs in building an inclusive workplace culture that enhances employee satisfaction and retention.

• Explore the power of belonging—how ERGs create community beyond job roles, leading to stronger employee engagement and performance.

• Recognize ERGs as leadership incubators that provide opportunities for professional growth, mentorship, and volunteerism, helping employees showcase their skills and potential.

• Gain actionable insights on launching, managing, or expanding ERGs to align with corporate values and business objectives.This program is sponsored by Diversity Project North America's Metrics & Insights Committee:

CPE INFORMATION:

Nicsa is pleased to offer this webinar learning activity to attendees who are seeking CPE credits. 1 CPE unit may be available for attendees of this webinar. The webinar requires no advanced preparation, no pre-requisite study and is appropriate for all who have a basic understanding of the investment management industry.

Nicsa is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org.

CPEs Earned: 1

CPE Field of Study: Personnel/Human Resources – Non-technical

Program Level: Basic

Delivery Method: Group-Internet Based

Advanced Preparation: None

CE Credits Redeemable with Investments & Wealth Institute™ (IWI)

Nicsa is a registered sponsor with the Investments & Wealth Institute™ (IWI) for continuing education credits applicable to CIMA®, CPWA®, RMA®, and CIMC® certifications. This 60-minute webinar has been pre-approved by IWI for 1 CE credit.

To redeem your CE credit, you must self-report your participation by visiting the Investments & Wealth Institute™ website: https://investmentsandwealth.org. Following the conclusion of the webinar, please enter the program date, program ID, program title, and Nicsa as the sponsoring organization. Nicsa will not report your participation on your behalf.

The Investments & Wealth Institute™ has final authority on the acceptance of individual courses for CE credit. If you have any concerns or complaints regarding registered sponsors, you may submit them via the IWI website: https://investmentsandwealth.org/contact-us.

CPEs Earned: 1

Continuing Education Topic: Supplemental - Leadership Programs

Program Format: Live Webinar

CANCELLATIONS AND REFUNDS: Due to this program being offered free of charge, there will be no refunds issued. Questions or Cancellations: Please contact Lilly Bahmani at info@nicsa.org

Please note by registering for this webinar, you are consenting to Nicsa sharing your information with the sponsor of this webinar, who may subsequently contact you. You may unsubscribe from these communications at any time. For more information, check out our Privacy Policy

Michael Kaneva

Director, Inclusion and Organizational Effectiveness

OPTrust

Michael Kaneva is the Director of Inclusion and Organizational Effectiveness at OPTrust. Over the past 25 years, he has worked across Canada in roles dedicated to organizational culture and development. Having worked in a broad spectrum of organizations from blue chip to governments, he has specifically focused on inclusion, diversity and equity as his career focus. A member of the 2SLGBTQAI+ community, someone living with a disability and a stalwart supporter of newcomers to Canada, Michael is dedicated to bringing meaningful and positive change in practical business solutions and addressing the issues of discrimination, racism, and unconscious biases.

Sonya Rorie, CFA (Moderator)

Deputy Chief Diversity Officer

Allspring Global Investments

Sonya Rorie is the deputy chief diversity officer at Allspring Global Investments. In this role, she works with the Chief Diversity Officer to improve Allspring’s internal culture and develop external strategies to encourage equal opportunity in diverse communities. Sonya joined Allspring from its predecessor firm, Wells Fargo Asset Management (WFAM). Prior to her current role, Sonya was a client relations director for the Institutional Client Group covering the Southeast region. She joined WFAM from Evergreen Investments, where she began her investment industry career in 2003. Prior to this, Sonya served as a senior auditor for Transamerica and KPMG. She earned a bachelor’s degree in accounting from the University of North Carolina at Charlotte. She is a certified public accountant and has earned the right to use the Chartered Financial Analyst® (CFA®) designation. Sonya is a member of CFA Society North Carolina and CFA Institute.

Anthony Almanzar

Vice President & Latin America Accounting Product Lead

State Street Corporation

Anthony joined State Street in 2015 as an Information Security Risk Analyst and more recently held a variety of roles in Identify & Access Management as a Business Analyst, Data Analyst, Solutions Analyst within Corporate Information Security and Business Risk Intelligence and Operations Manager for State Street Global Markets, and most recently a Senior Program Manager for State Street Global Advisors. Anthony is currently the Accounting product lead for Latin America. He is responsible for driving Accounting Product strategy for the Latin America region and organizational growth within the emerging region.

Prior to joining State Street, Anthony has worked as a Forecasting Analyst and Product Development in Italy for various boutique firms. During that time, he was focusing on Fixed Income research, quantitative modeling, tactical benchmark solutions, and portfolio construction for the clients he served. Additionally, Anthony managed the transformation efforts around operational efficiency and process automation.

Anthony has a Master’s in Business Analytics and Consulting from IESEG School of Management in Paris. He has earned a Bachelor’s degree in Finance and Accounting Management from Northeastern University and is actively seeking a Professional Masters in Data Analytics from Northeastern University.

Anthony is the former Chair of the Latin American Professionals Network (LAPN), which a nationally recognized employees resource group (ERG) at State Street. Under his leadership LAPN has received a number of national-level awards for their impact and contribution to advancing Diversity, Equity, and Inclusion (DEI). Anthony represents State Street in various external engagements and professional conventions. He is currently the interim Co-Chair of the Asian Professional Network (APN).

He is currently an active workstream member of Action #8 from the 10 Actions Against Racial & Inequality. Anthony is an advisory board member for Fisher College and the Boston Chapter of TecHire. Additionally, Anthony is a recipient of the 2022 Young Hispanic Corporate Achievers Awards by the Hispanic Association on Corporate Responsibility (HACR). In 2023 Anthony served as the Director of Financial Literacy for the Boston chapter of the Association of Latino Professionals for America (ALPFA). In 2023, he was recognized by the LAPN with Excellence in Leadership Award and with the Emerging Leader Nova Award by NICSA. In 2024 Anthony was appointed as a member of the CEO Advisory Council of the DEI Project for NICSA representing State Street Corporation.

Abu Toppin

Compliance Business Partner

MFS Investment Management

Twenty plus years of Legal and Compliance experience in the Financial Services industry. Exceptional change agent with the ability to provide quality advice, guidance and support. Reputation for increasing engagement across departments, community and business partners, complemented by excellent presentation skills and a collaborative leadership style to foster critical partnerships and definitive decision making. Highly skilled change agent and leader who can collaborate with others to inspire and support an inclusion and diversity strategy through every part of an organization.

-

Register

- Prices available after logging in

- More Information

-

Register

-

Includes Credits

Join us for an engaging discussion on the practical applications of AI and discover how your organization can leverage these advancements for sustained operational excellence.

Artificial Intelligence (AI) is revolutionizing back-office operations, enhancing efficiency, accuracy, and scalability in ways previously unimaginable. This webinar will explore actionable and realistic AI-driven strategies that streamline data processing, improve risk management, and optimize operational workflows. Our expert panel will delve into real-world use cases, providing valuable insights into how AI is reshaping the back office and driving business transformation.

Join us for an engaging discussion on the practical applications of AI and discover how your organization can leverage these advancements for sustained operational excellence.

Learning Outcomes:

By the end of this webinar, participants will be able to:

- Understand AI Use Cases: Understand how AI is currently impacting back-office operations and its evolving role in financial services.

- Enhance Operational Efficiencies: Learn how to leverage AI to improve speed, accuracy, and cost-efficiency in daily operations.

- Plan for Scalability: Gain insights into building an AI-powered, future-proof operating model for sustained growth in investment management.Target Audience:

The target audience for the webinar includes:

Financial Services Professionals, Operations and Back-Office Teams, Compliance and Risk Management Professionals, Technology and Innovation Leaders, Fund Administration and Custodian Bank Professionals, C-Suite and Decision-Makers, AI and Data Science Experts in Financial Services, CPAs and Other CPE Credit Seekers

This program is co-hosted by GFT.

CPE Credits Redeemable with NASBA

Nicsa is pleased to offer this webinar learning activity to attendees who are seeking CPE credits. 1 CPE unit may be available for attendees of this webinar. The webinar requires no advanced preparation, no pre-requisite study and is appropriate for all who have a basic understanding of the investment management industry.

Nicsa is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org.

CPEs Earned: 1

CPE Field of Study: Information Technology – Technical

Program Level: Basic

Delivery Method: Group-Internet Based

Advanced Preparation: None

CE Credits Redeemable with Investments & Wealth Institute™ (IWI)

Nicsa is a registered sponsor with the Investments & Wealth Institute™ (IWI) for continuing education credits applicable to CIMA®, CPWA®, RMA®, and CIMC® certifications. This 60-minute webinar has been pre-approved by IWI for 1 CE credit.

To redeem your CE credit, you must self-report your participation by visiting the Investments & Wealth Institute™ website: https://investmentsandwealth.org. Following the conclusion of the webinar, please enter the program date, program ID, program title, and Nicsa as the sponsoring organization. Nicsa will not report your participation on your behalf.

The Investments & Wealth Institute™ has final authority on the acceptance of individual courses for CE credit. If you have any concerns or complaints regarding registered sponsors, you may submit them via the IWI website: https://investmentsandwealth.org/contact-us.

CPEs Earned: 1

Continuing Education Topic: Wealth Management: Risk Management and Asset Protection

Program Format: Live Webinar

CANCELLATIONS AND REFUNDS: Due to this program being offered free of charge, there will be no refunds issued. Questions or Cancellations: Please contact Lilly Bahmani at info@nicsa.org

Please note by registering for this webinar, you are consenting to Nicsa sharing your information with the sponsor of this webinar, who may subsequently contact you. You may unsubscribe from these communications at any time. For more information, check out our Privacy Policy

Eugene Klechevsky (Moderator)

Client Unit Director, GFT

Eugene Klechevsky is a Client Unit Director for Asset Management at GFT. With over 20 years of experience, Eugene specializes in account management for private equity clients, building and maintaining key relationships and ensuring alignment with client needs. He manages partnerships and guides clients through complex fund structures, reporting and data challenges using platforms like LemonEdge, Investran, Dynamo and Salesforce. Supported by a global team of over 12,000 experts, Eugene ensures seamless delivery of solutions such as automation, integration, reporting by leveraging both onshore and nearshore resources for optimal client outcomes.

Brian Gauvain

Director Fund Services Product, Citi

Brian joined Citi in September 2022 as a Director within the Fund Services Operations Team. Brian brings over 25 years of Fund Services, ETF industry and market experience. Brian is responsible for Global Fund Accounting Operations and ETF Services. Brian is also responsible for driving improvements around the global accounting model.

He joins from J.P. Morgan where he was the Global Head of ETF Services and US Accounting. Brian in his past roles focused on improving the accounting and ETF products with the growing industry, optimizing/improving daily operations and building scale within the daily fund services model.

Brian earned a B.S. in finance at Salem State University.

Christoph Krey

Global Client Service Executive Director, JP Morgan

Christoph Krey is an Executive Director at JPMorgan Chase, specializing in Global Client Service & Solutions with over 19 years of experience in financial services. He oversees global asset manager relationships across all products and services within the Securities Services department. His primary responsibilities include ensuring client satisfaction with JPMorgan Chase as a trusted strategic partner, driving continuous improvement, consulting on industry standards versus bespoke methods, and providing scalable, cost-effective solutions. Christoph has managed teams in Operations, Technology, Product, and Client Service. Before joining JPMorgan Chase, he worked at Brown Brothers Harriman.

Kaushal Sheth

Chief Architect Officer, GFT Technologies

Kaushal is the Chief Architect for GFT Americas. He has over 28 years in building solutions across the U.S., E.U. and Latin America for Banks and Capital Markets. Kaushal co-founded Sophos Solutions, a leader in financial technology solutions in Latin America, where it was recently

acquired by GFT. He is a graduate of NIIT and GMP Harvard Business School. Kaushal co-founded many other startups such as Deepmoney.ai and Brain.studio, advises to multiple Fintechs, is a board member of Technology and Fintech companies PTM Commercial Card and ITR Machines. He is a leading expert in emerging Computational Neuroscience field and focused on a mission to build next generation of intelligent machines.

Mike Srdanovic

Chief AI Architect, Northern Trust

Mike is the Chief AI Architect for Northern Trust focused on Data Science and Emerging Technologies. His role encompasses working with Business executives and leader to promote innovation and digital transformation encompassing AI and other emerging technologies as well as setting standards, patterns and tools selection for the bank.

Mike has been with Northern Trust for over 20 years in various leadership roles. Prior to joining Northern Trust he participated in several software startups. He received his BSEE undergraduate degree from Lakehead university and his MSEE graduate degree from the University of Windsor.

-

Register

- Prices available after logging in

- More Information

-

Register

-

Includes Credits

Join us for an insightful webinar to explore the evolving landscape of semi-liquid alternative fund investments, a rapidly growing segment that blends attributes of both mutual funds and alternative investments.

Join us for an insightful webinar to explore the evolving landscape of semi-liquid alternative fund investments, a rapidly growing segment that blends attributes of both mutual funds and alternative investments.

Our panel of industry leaders will provide deep insights into hybrid funds that combine key features of mutual funds and alternative investments, highlighting why these innovative structures are gaining traction among specific investor segments. Additionally, we'll explore emerging trends and future developments shaping this dynamic investment landscape.

We will discuss key product characteristics, investor considerations, regulatory requirements, and anticipated developments in the market. The session will conclude with a live Q&A, allowing attendees to engage directly with our panelists.

Learning Outcomes:

By the end of this webinar, participants will:

- Gain a comprehensive understanding of semi-liquid alternative fund structures and their investment attributes.

- Explore why these hybrid products are gaining traction and the types of investors they are best suited for.

- Identify potential risks, liquidity considerations, and regulatory requirements associated with these investments.

- Examine real-world examples of semi-liquid alternative investment strategies and discuss emerging trends in the space.

Target audience:

This webinar is designed for professionals in the financial services industry, offering diverse perspectives from:

- Asset managers overseeing alternative investments.

- Investment consultants advising institutional and high-net-worth investors.

- Investment recordkeeping system and service providers supporting fund operations.

This program is sponsored by FIS:

FIS is a financial technology company providing solutions to financial institutions, businesses, and developers. We unlock financial technology to the world across the money lifecycle underpinning the world’s financial system. Our people are dedicated to advancing the way the world pays, banks and invests, by helping our clients to confidently run, grow, and protect their businesses. Our expertise comes from decades of experience helping financial institutions and businesses of all sizes adapt to meet the needs of their customers by harnessing where reliability meets innovation in financial technology. Headquartered in Jacksonville, Florida, FIS is a member of the Fortune 500® and the Standard & Poor’s 500® Index. To learn more, visit FISglobal.com. Follow FIS on LinkedIn, Facebook and X.

CPE Credits Redeemable with NASBA

Nicsa is pleased to offer this webinar learning activity to attendees who are seeking CPE credits. 1 CPE unit may be available for attendees of this webinar. The webinar requires no advanced preparation, no pre-requisite study and is appropriate for all who have a basic understanding of the investment management industry.

Nicsa is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org.

CPEs Earned: 1

CPE Field of Study: Finance

Program Level: Basic

Delivery Method: Group-Internet Based

Advanced Preparation: None

CE Credits Redeemable with Investments & Wealth Institute™ (IWI)

Nicsa is a registered sponsor with the Investments & Wealth Institute™ (IWI) for continuing education credits applicable to CIMA®, CPWA®, RMA®, and CIMC® certifications. This 60-minute webinar has been pre-approved by IWI for 1 CE credit.

To redeem your CE credit, you must self-report your participation by visiting the Investments & Wealth Institute™ website: https://investmentsandwealth.org. Following the conclusion of the webinar, please enter the program date, program ID, program title, and Nicsa as the sponsoring organization. Nicsa will not report your participation on your behalf.

The Investments & Wealth Institute™ has final authority on the acceptance of individual courses for CE credit. If you have any concerns or complaints regarding registered sponsors, you may submit them via the IWI website: https://investmentsandwealth.org/contact-us.

CPEs Earned: 1

Continuing Education Topic: Traditional and Alternative Investments

Program Format: Live Webinar

CANCELLATIONS AND REFUNDS: Due to this program being offered free of charge, there will be no refunds issued. Questions or Cancellations: Please contact Lilly Bahmani at info@nicsa.org.

Please note by registering for this webinar, you are consenting to Nicsa sharing your information with the sponsor of this webinar, who may subsequently contact you. You may unsubscribe from these communications at any time. For more information, check out our Privacy Policy.

Mike Melles (Moderator)

Senior Director, FIS Transfer Agency Solutions

Mike is a Senior Director at FIS and is Head of Product Management. Mike has over 30 years’ experience in global transfer agency. In his current role, Mike is responsible for monitoring industry trends, regulations and consult with clients to determine the important updates required with the software and services we provide to many leading organizations in the financial services industry. Mike also serves on the Investment Company Institute’s Broker-Dealer Advisory Committee and the Board of Directors of the Nicsa organization. Mike holds a Bachelor of Business Administration degree from the University of Iowa and an MBA from University of St. Mary’s University.

Greg Mino

SVP, Northern Trust

Greg joined Northern Trust Asset Servicing, Global Fund Services in 2020. He is a SVP and business manager with a focus on U.S. registered funds and the Series Trust product lines. Greg is Vice President/Officer of the Advisers Investment Trust and Datum One Series Trust®.

Previously, Greg held senior positions at firms including Nuveen Investments, UBS Global Asset Management and Merrill Lynch Investment Managers over his 30-year investment services career.

Cian Hyland

Solution Manager, FIS

Xinhao Sun

Director. PwC

Xinhao Sun is an Audit Director in PwC's Asset and Wealth Management (AWM) practice, with over 13 years of experience serving a diverse range of asset management clients across both registered and unregistered funds. He leads multiple AWM sector workstreams nationally, supporting teams and clients in the semi-liquid funds space, specializing in business development companies, interval funds, and tender offer funds. Xinhao holds a master’s degree in Professional Accounting from the University of Texas at Austin.

-

Register

- Prices available after logging in

- More Information

-

Register

-

Includes Credits

Join Nicsa for an insightful session on the growing importance of sustainable investment funds and their incorporation of ESG (environmental, social and governance) factors in the global investment landscape, with a special focus on Luxembourg’s pivotal role in this space.

Join us for an insightful session on the growing importance of sustainable investment funds and their incorporation of ESG (environmental, social and governance) factors in the global investment landscape, with a special focus on Luxembourg’s pivotal role in this space. This webinar will explore recent developments for ESG funds and how they can align with international standards or regulatory frameworks, including the Corporate Sustainability Reporting Directive (CSRD).

Our expert panel will share trends driving ESG fund adoption, and highlight real-world success. Gain valuable insights to help position your firm for success in the fast-evolving ESG ecosystem.

Learning Outcomes

-Understand Luxembourg’s leadership in the ESG fund space and recent developments of the sustainable finance framework

-Explore trends in ESG investing

-Gain practical insights on challenges regarding CSRD compliance and their implications for ESG fund management

-Discover proposals to enhance ESG fund adoption and drive sustainable investment growth

Target audience

Professionals within the global asset management and investment fund industry, including in the private assets space, focused on Fund and Investment Compliance, Fund Accounting, Risk Management, Portfolio Management, Operations, and Legal

This program is sponsored by:

CPE INFORMATION:

Nicsa is pleased to offer this webinar learning activity to attendees who are seeking CPE credits. 1 CPE unit may be available for attendees of this webinar. The webinar requires no advanced preparation, no pre-requisite study and is appropriate for all who have a basic understanding of the investment management industry.

Nicsa is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org.

CPEs Earned: 1

CPE Field of Study: Specialized Knowledge

Program Level: Basic

Delivery Method: Group-Internet Based

Advanced Preparation: None

CE Credits Redeemable with Investments & Wealth Institute™ (IWI)

Nicsa is a registered sponsor with the Investments & Wealth Institute™ (IWI) for continuing education credits applicable to CIMA®, CPWA®, RMA®, and CIMC® certifications. This 60-minute webinar has been pre-approved by IWI for 1 CE credit.

To redeem your CE credit, you must self-report your participation by visiting the Investments & Wealth Institute™ website: https://investmentsandwealth.org. Following the conclusion of the webinar, please enter the program date, program ID, program title, and Nicsa as the sponsoring organization. Nicsa will not report your participation on your behalf.

The Investments & Wealth Institute™ has final authority on the acceptance of individual courses for CE credit. If you have any concerns or complaints regarding registered sponsors, you may submit them via the IWI website: https://investmentsandwealth.org/contact-us.

CPEs Earned: 1

Continuing Education Topic: Wealth Management

Program Format: Live Webinar

CANCELLATIONS AND REFUNDS: Due to this program being offered free of charge, there will be no refunds issued. Questions or Cancellations: Please contact Lilly Bahmani at info@nicsa.org

Please note by registering for this webinar, you are consenting to Nicsa sharing your information with the sponsor of this webinar, who may subsequently contact you. You may unsubscribe from these communications at any time. For more information, check out our Privacy Policy

Please note by registering for this webinar, you are consenting to Nicsa sharing your information with the sponsor of this webinar, who may subsequently contact you. You may unsubscribe from these communications at any time. For more information, check out our Privacy Policy

Denise Voss (Moderator)

Chairwoman

LuxFLAG

Denise Voss is a Non-Executive Director and Chairwoman of flagship funds of major fund promoters.

Denise has worked in the financial industry in Luxembourg since 1990. She retired from Franklin Templeton in 2020 after 25 years, where she was a Conducting Officer and Director of Franklin Templeton’s Luxembourg management company. Prior to that she worked for 10 years at Coopers & Lybrand in Boston, USA and Luxembourg. She obtained a BA from Tufts University, and an MSc in accountancy from Bentley University. Ms Voss is currently Chairwoman of LuxFLAG, an agency supporting the financing of sustainable development and a board member of Accelerating Impact Finance Luxembourg. She is also Chairwoman of the EFAMA Investor Education Platform, was Chairwoman of ALFI from 2015-2019, a member of the ALFI board from 2007-2019 and is currently a member of the ALFI Strategic Board.

Thomas Goericke

Partner

Elvinger Hoss

Tom Göricke’s practice focuses on collective asset management and investment funds with a specific focus on rules regarding sustainable finance and ESG. Tom advises clients on the set-up and structuring of their Luxembourg investment fund operations as well as on regulatory matters. He leads the firm’s sustainable finance task force and actively participates in various industry association working groups on this subject. Prior to joining the firm, Tom trained as a solicitor of England and Wales. Member of the British Chamber of Commerce legal group. Chairman of the ALFI Responsible Investing Committee working group H1 – (SC) RI Legal and Policy. Member of ALFI working groups on sustainable finance. Member of the Luxembourg Bar since 2010. Member of the Law Society of England and Wales since 2009. Solicitor of England and Wales since 2009.

Agathi Pafili

Vice President, Head of Government Relations

Capital Group

Agathi Pafili is Vice President at Capital Group and is head of Europe government and regulatory affaits. She has 21 years of policy and industry experience and has been with Capital Group for over 5 years. Prior to joining Capital, Agathi was a senior policy advisor at the European Funds and Asset Management Association. Before that, she worked in the European Parliament as policy advisor fand head of office for Members of the Economic and Monetary Affairs Committee. She holds a master's degree in international and European law and is a member of the Athens Bar Association. Agathi is based in Brussels.

Désirée Doenges

Senior Vice President Legal

ALFI

Désirée Doenges joined ALFI’s legal department in January 2020. She holds a German degree in law with a specialisation in administrative law and a diploma in Luxembourg taxation. At ALFI, she handles files on regulatory and legal issues and is involved in the work of the association’s technical committees. In particular, Désirée is coordinator of ALFI’s responsible investing working groups.

-

Register

- Prices available after logging in

- More Information

-

Register